Wired for profit

Building transmission networks to export Iowa's wind power is 'win-wind,' say developers

What will that mean for Iowa businesses and consumers, and how will this benefit the state?

• Building more transmission capacity is critical to the future of Iowa’s wind industry. Growth now is constrained by limited transmission capacity from Midwest states to more densely populated areas where demand for electricity is growing the fastest.

• Building transmission networks will create significant opportunities for construction companies and other businesses servicing the utilities industry.

• Anywhere from 17,000 to nearly 40,000 construction jobs could be created in the Midwest, according to estimates on some of the projects.

• Consumers eventually will benefit through lower electricity rates.

Pathway to larger markets

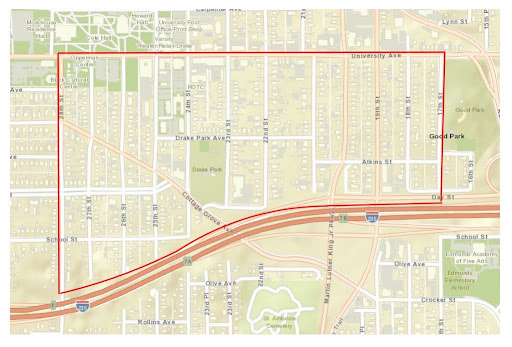

Among the projects in the planning stages is Rock Island Clean Line, a proposed 500-mile direct-current line that would transmit electricity generated by wind farms in Iowa, Minnesota, Nebraska and South Dakota to Illinois. From there, the line would connect to the East-Coast grid known as the Pennsylvania-New Jersey-Maryland Interconnection (PJM). A regional transmission organization, PJM Interconnection LLC, coordinates the movement of wholesale electricity in 13 East Coast states and the District of Columbia; its counterpart in the Midwest is the Midwest Independent Transmission System Operator Inc (MISO).

“We’ve really been working on this project since the beginning of 2010,” said Cary Kottler, director of Clean Line Energy Partners, which is based in Houston and wants to develop the Rock Island Clean Line. “We saw that Iowa has this tremendous wind resource.” Just as farmers need to get their crops to market, the Rock Island project will carry Midwest-generated electricity to the East Coast, he said.

Although the wind industry has been laying off production workers in anticipation of the federal production tax credit expiring at the end of this year, transmission developers take a longer view, said Hans Detweiler, Clean Line’s director of development.

“We think that in the long term, regardless of what happens in the near term with the production tax credit, there will be policies in place to encourage the development of renewable energy resources, just as there are policies in place that encourage the development of all forms of generation today,” he said.

The Rock Island project is one of a family of four regional projects that Clean Line is simultaneously developing across the country. To the south, the company is developing the Grain Belt Express, which will cross Kansas, Missouri and Illinois; the Plains & Eastern line, which will transect Oklahoma and Arkansas into Tennessee; and Centennial West, which will move solar-generated electricity west from New Mexico and Arizona to California.

The Rock Island project, which is expected to be completed by 2017, will support more than 4,000 megawatts of new wind farms, or approximately 2,000 additional wind turbines, Kottler said. “That represents an investment of more than $7 billion to build all those wind farms in western Iowa,” he said.

Clean Line Energy Partners recently received approval from federal regulators to begin the process of negotiating rates and soliciting customers. The additional capacity should drive further development, Kottler said.

“We talk with the wind developers very frequently, and what we hear from them is that if there’s a pathway to the market, they greatly look forward to developing new wind farms,” he said.

Routes within the Midwest

Other projects presented in August to the Iowa Utilities Board were more intraregional in nature – initiatives to carry more power to areas within MISO’s grid.

Several of those projects are so-called Multi-Value Projects (MVPs), a new classification by MISO in which the development costs are allocated across the region based on the percentage of energy used in each area within the region. For example, MidAmerican Energy Co. and ITC Midwest LLC are collaborating on a group of MVPs to provide enhanced connections from wind farms in northwest Iowa to Wisconsin and Illinois.

MISO estimates its total portfolio of 17 MVPs will create between 17,000 and 39,800 construction jobs throughout the Midwest, and that consumers will see economic benefits of between 1.8 and three times the investment costs.

The prospective transmission projects are “pretty exciting to us at the wind energy association,” said Harold Prior, executive director of the Iowa Wind Energy Association. “It’s obvious that there’s a lot of investments about to happen, along with a lot of tax revenue and billions in additional wind development,” he said. “This will be an absolute boom, and what’s nice is it’s all privately funded.”

Prior credited rulemaking by the Federal Energy Regulatory Commission (FERC) this year with creating an environment for more transmission projects to move forward. FERC Rule 1000 mandated that regional and interregional cost allocation methods must meet certain principles, including that allocated costs be “roughly commensurate” with estimated benefits, and that those who do not benefit from transmission do not have to pay for it.

For end users of energy, the big question is whether the added infrastructure investments will result in lower electricity costs.

According to an independent study completed earlier this year, increasing wind energy production and transmission in the Midwest will likely lower energy costs. The study, completed in May by Cambridge, Mass.-based consulting group Synapse Energy Economics Inc., estimated that adding more wind power to the grid could save consumers up to $200 a year on their energy bills by 2020.

“In sum, this study suggests that adding more wind power to the grid in MISO, above and beyond what will be enabled by the MVP portfolio, would result in the continual decline of energy market prices and generally lead to lower overall electric rates for ratepayers (relative to rates in a less windy electrical landscape) — even when you factor in the costs of additional transmission,” the report said.

At the end of 2011, wind turbines installed in the MISO region had increased to 10 gigawatts (GW), or 10,000 megawatts, of annual energy production. According to the Synapse study, if installed wind production capacity increases to 30 GW by 2020, the market price of electricity should decrease by approximately $14 per megawatt-hour (MWH), or an annual savings of between $63 and $147 for the average residential user. If wind capacity increases to 40 GW, the average energy price decline would be more than $21 per MWH, or $71 to $200 in savings per year per average residential user.

Iowa’s consumer watchdog advises caution on adding transmission lines, though. In a communication with the Iowa Utilities Board, the Iowa Office of Consumer Advocate recommended that the proposed Midwest transmission projects be independently reviewed to prove the need for the investments.

Who pays?

Who’s paying the upfront costs of these types of projects? The Rock Island project is funded by development capital from long-term investors led by Ziff Bros. Investments, a New York City-based venture fund with an energy and infrastructure portfolio. Once the project is permitted and wind farms have signed contracts, Clean Line Partners will go out into the capital markets to seek investors.

“There’s a really strong appetite to invest in infrastructure because it’s a fairly safe, guaranteed long-term return for various infrastructure funds and entities like that,” Detweiler said.

“We think there should be local benefits along the way,” Kottler said. “Our construction adviser is committed to using local services to the greatest extent possible, so that’s why we’re having community meetings to determine the local capabilities.”

Proposed projects in the Midwest

American Transmission Co. Cardinal Bluffs Project

• What: 125-mile transmission line from southwestern Wisconsin to Iowa

• Estimated cost: $425 million

• In-service date: December 2018

Duke/American Transmission Co. Midwest Portfolio Project

• What: Phase 4 of 7-phase, 5-state project from northwestern Iowa to central Illinois

• Estimated cost: $2 billion

MidAmerican Energy Co./Ameren Illinois

• What: Oak Grove to Fargo, Ill., project to connect two Illinois transmission facilities that are each directly connected to Iowa facilities.

• Estimated cost: $69 million

Rock Island Clean Line

• What: 500-mile direct current line with one converter station each in Iowa and Illinois

• Estimated cost: $1.7 billion

• In-service date: 2017

MidAmerican Energy Co. /ITC Midwest

• What: Four projects ranging from 32 to 120 miles in Iowa, Wisconsin and Illinois

• In-service date: 2015 to 2017

Electric Transmission America/MidAmerican Energy subsidiary

• What: 265-mile line from Adair County, Iowa, to Henry County, Ill.; or 235-mile line from Black Hawk County, Iowa, to Henry County, Ill.

ITC Holdings Corp./MidAmerican Energy Co. Lakefield-Hazelton Project

• What: More than 400 miles through southwest Minnesota, northwest and north-central Iowa

• In-service date: Between 2016 and 2018

Wind on Rails Inc.

• What: 450-mile direct current line from Council Bluffs, Iowa, to Joliet, Ill.

Midwest wind to fill shortfall

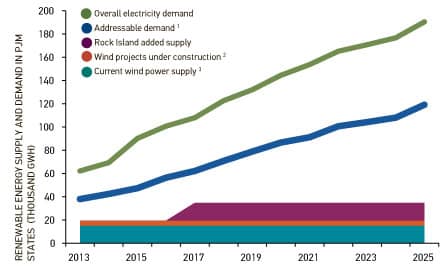

To illustrate the gap between overall electricity demand in the Middle-Atlantic states served by the Pennsylvania-New Jersey-Maryland Interconnection (PJM), Clean Line Energy Partners devised this graphic that shows how its Rock Island Clean Line project would about double supply from wind projects, but still leave a considerable amount of demand for projects needed to meet renewable energy goals. The purple bar represents the added energy that the Rock Island project would provide.

1: Demand for renewable energy credits within PJM for which Rock Island Clean Line wind would be eligible.

2: Wind projects currently under construction within the PJM states.

3: Energy from existing wind projects within the PJM states.

Source: Clean line energy partners