2016 Economic Forecast: Leader forecast

In 2016 I believe the Iowa economy will...

BUSINESS RECORD STAFF Jan 29, 2016 | 12:00 pm

11 min read time

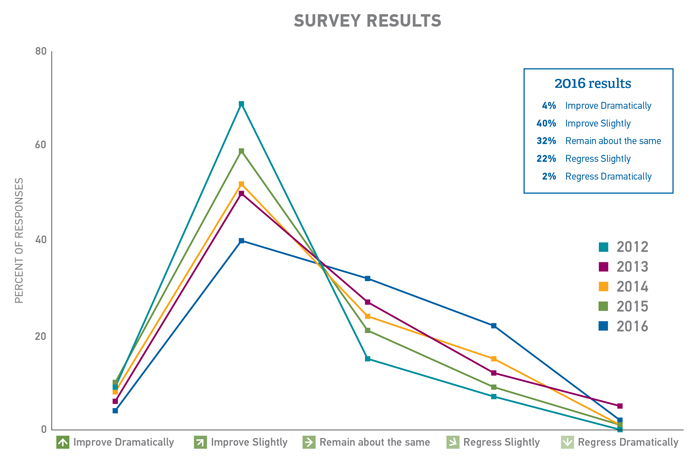

2,521 wordsArts and Culture, Banking and Finance, Business Record Insider, Economic Development, Education, Energy, Government Policy and Law, Health and Wellness, Insurance, Manufacturing, Real Estate and Development, Retail and Business, Sales and Marketing, TransportationThis is the fifth year we’ve asked the same question to the same audience, and although it’s an unscientific survey, one clear trend emerges from it: Hesitant optimism over the past four years has certainly been tempered.

To measure the economic temperature of business leaders here in Iowa, we had our reporters poll leaders in the industries they cover, and we set up an online poll for all of our readers. We asked respondents to answer a multiple-choice question to gauge whether the community thought Iowa’s economy will be improving, regressing or staying the same. Then we asked each respondent to answer the question “What do you think the impact will be of the economy on your particular industry?”

Only 44 percent of respondents thought the economy would improve, either slightly (40.1 percent) or dramatically (4.2 percent). That’s down 25 percentage points from last year’s 69 percent, and the lowest reading since we began the survey in January 2012.

The percentage of respondents who thought the economy would remain the same grew to 31 percent from last year’s 21 percent, and that again was the highest since we began the survey.

But perhaps most telling, is that 24 percent of respondents expect the Iowa economy to regress, either slightly (21.8 percent) or dramatically (2.4 percent), up from just 10 percent of respondents last year. And, you guessed it, this was the largest percentage of respondents anticipating a regression since we began the survey.

In reading through the comments, there’s no doubt that optimism is being tempered by global events. Yet, keep in mind, although there was a clear trend toward a belief in regression from a belief in improvement for 2016, still more people believe improvement (44 percent) is in store for Iowa’s economy than regression (24 percent).

– Chris Conetzkey, editor of the Business Record

We asked: What will the impact be of the economy on your particular industry?

Economic Development

Improve slightly

The Federal Reserve signaled confidence in the economy in December. A January jobs report from the Labor Department provided better-than-expected numbers. Iowa employment continues upward. The metro area continues to rack up top economy and quality-of-life rankings. Numerous projects will benefit from state, regional and local economic development initiatives that are bold, coordinated and responsive to business. Dramatic economic improvement is likely tempered by the election and lingering corporate reluctance to make capital expenditures. For economic development, 2016 is an opportunity to shape policies and invest in infrastructure to capitalize on the strengthening economy and growing business confidence.

Curtis Brown

Director of Economic Development, City of Urbandale

Nonprofits

Improve slightly

It seems like Central Iowa’s diverse economy should continue its slow but steady growth in 2016. At the national level, the Federal Reserve raising interest rates might be a sign of confidence. Locally, insurance and financial services seem to be staying strong, which leads to strong employment and consumer spending, although the agricultural sector may be facing some headwinds. The overall economic strength tends to ripple through nonprofits, primarily through philanthropy, which helps us fulfill our mission. We in the nonprofit sector are grateful for strong employment and the generosity and leadership of the business community.

Mary Sellers

President, United Way of Central Iowa

Real Estate & Development

Improve slightly

The commercial real estate industry will continue to be strong in 2016; however, the continued shortage of skilled building tradespeople will push construction costs up. The probable increases in interest rates along with increases in project costs will begin to temper the red-hot growth and give some pause to projects with narrow parameters. The downtown market will continue to be robust as the numbers of new hot spots, art/cultural opportunities and housing options continue to grow. Growth will continue for the foreseeable future, as downtown becomes a more walkable and desirable destination.

Jake Christensen

President, Christensen Development

Sales & Marketing

Regress slightly

The advertising and marketing budgets are usually the first things to get cut in a down economy. We experienced significant growth in 2015 as companies started investing in growth and opportunities. I believe the political and world turmoil in 2016 will cause companies to sit on the sidelines and wait to see how things shake out. I think this would normally cause our industry to stay flat, but with low commodity prices and the heavy connection to the agriculture industry in our state, I can see a slight pullback in the overall local economy. There will continue to be pockets of opportunity in specific industries and geographies. Our company will focus on those niches in 2016. I believe we will take a small step back overall. I believe the European and Chinese economies will make investors uneasy and will not allow for gains across the board. Political turmoil with ISIS, North Korea and Iran will keep larger corporations from expanding globally. U.S. trade deficits and budget deficits will continue to weaken our domestic economy. Locally, lower commodity prices will affect agriculture and will have a trickle-down effect throughout the Iowa economy. Luckily, Iowans are more conservative financially and steps backward are easier to absorb with lower debt loads.

Todd Senne

President, Trilix

Retail & Business

Improve slightly

The East Village continues to thrive as a tourism and shopping destination. In 2016 and into 2017, we expect to see our sales continue to moderately increase as over 2,000 new apartments and townhomes open downtown. This will add hundreds of new pets looking for healthy foods and quality pet supplies. More than 200 new hotel rooms will be added to the East Village in 2016, bringing visitors into the heart of the neighborhood.

Josh Garrett

Co-owner, Jett and Monkey’s Dog Shoppe

Real Estate & Development

Remain about the same

Agriculture will find financial stability in 2016. The migration from rural Iowa to metro cities will continue to grow. Metro area population growth will allow companies to expand, demanding qualified employees. The education of our children and our workforce is critical to all Iowans – of all ages. Iowa’s educational system needs to be analyzed asking the question – “are we meeting the vision and expectations of employers to expand opportunity in the state.” Focusing on key areas – agriculture and infrastructure along with technology and science – should be the goal. Instead of Iowans moving out of state, let’s give them something to stay for and tell them why! Iowa offers many positives in spite of our mountain/ocean challenge. The shortage of available workforce will be our greatest challenge for growth.

Mona Bond

Environmental Director, Manatts Inc.

Health & Wellness

Remain about the same

Mercy Medical Center anticipates that the Iowa economy in 2016 will remain about the same as 2015. With the continued pressure from a low unemployment rate and with a shortage of qualified workers to fill open positions, state businesses will experience an increasing cost of hiring staff and the need for a more competitive pay and benefits package. With the poor performance of the stock market, we also believe philanthropy will decrease as portfolio values decline, and if the market downturn persists, consumer confidence will likely decline. Lower consumer confidence will lead to a softening of demand for elective health care procedures. In addition, with the state’s planned transition to Medicaid managed care and the privatization of the program, we forecast lower revenue for providers. We do, however, remain optimistic about the future of Mercy Medical Center and our affiliated organizations, and therefore we will continue our annual capital spend rate in balance with our performance. Capital will be focused in the areas of information technologies, digital connections and master campus plans. We do feel fortunate to be in Iowa and Des Moines, where our economy tends to outperform national indicators in several key economic categories.

Bob Ritz

President, Mercy Medical Center-Des Moines

Insurance & Investments

Improve slightly

No doubt the economy will have an impact on our industry. For the first time in many years, the idea of higher interest rates is a reality. How advisers manage and react to this change will be important to clients and advisers in 2016 and for years to come, especially those in or near retirement. As critical and impactful as the economy are several ongoing issues. The long awaited Department of Labor Fiduciary Standard appears to be leading to a significant change in the way representatives and advisors approach the retirement marketplace. How this will happen looks to play out in 2016. Additionally there is the need to focus on risk management and to protect against cyberattacks, which seem all too common in 2015 and into 2016. Also, the Robo Adviser movement will continue to develop meaning as always, so advisers need to be mindful of the best options for their clients related to managing their assets effectively. In an ever-changing technological time, technology continues to push through new fronts within our industry.

Matthew Stahr

Managing director/chief compliance officer, VisionPoint Advisory Group

Real Estate & Development

Improve slightly

2015 was a very strong year for the design business, and 2016 looks to be even stronger. Generally the strength of the design industry has an exponential effect in other areas as well, such as engineering, construction and related trades, which will bode well for our area.

Davis Sanders

Principal, RDG Planning & Design

Retail & Business

Remain about the same

We will continue to have low but steady growth (2.5 percent) in the restaurant industry. People don’t stop going to restaurants when the economy is sluggish, they just order differently – more water, fewer appetizers and desserts. Patron numbers are steady, but table checks suffer.

Jessica Dunker

President & CEO, Iowa Restaurant Association

HR & Education

Improve slightly

The economy will continue to expand and improve, but it may be a bumpy ride. We see significant growth in the demand for mobile and social applications to support businesses. Customers will demand simple and intuitive tools to help them purchase and access goods and services from organizations. Experienced leaders within organizations will retire at record levels, creating a strong need to rapidly prepare the next generation of leadership talent within organizations. New advancements in virtual technology and mobile/social software applications will help organizations address some of these training and development challenges.

Frank Russell

CEO, Prositions Inc.

HR & Education

Remain about the same

For many businesses, growth will come less from technological advances and more from providing a consistent and exemplary customer experience and by fostering an exceptional organizational culture for employees. These are advantages that are difficult for competitors to copy. Companies will continue to invest in the intangibles, the development of their leaders and workforce, to remain competitive and shape their brand and reputation.

Rowena Crosbie

President, Tero International, Inc.

Transportation

Improve slightly

Because Ruan serves a broad range of industries with both our supply chain solutions and our dedicated truck fleets, we expect moderate growth in the coming year, which will generally trend with the overall economy. Yet, even slight improvements in freight volume will cause additional stress on trucking capacity, which is already constrained by a shortage of professional drivers. In such an environment, dedicated contractual transportation solutions that allow shippers to secure capacity will often expand at higher rates than broader measures of freight growth. In addition, we expect larger increases in demand for supply chain solutions services like ours, because we help customers manage tightening capacity by better planning, optimizing and controlling their spending on all modes of transportation.

Ben McLean

CEO, Ruan Transportation Management Systems Inc.

Energy & Environment

Remain about the same

Iowa’s investor-owned electric and natural gas utilities anticipate the economy in 2016 to remain about the same, with little impact on their current operations. Iowa’s leadership in renewable energy is expected to continue with additional project investments across the state. The companies will continue to devote significant resources to reducing air emissions and toward compliance with the federal Clean Power Plan. Expanding customer services and delivering energy savings programs will remain a priority, as will the evaluation of new technologies on utility systems. Another major focus for the industry in 2016 will be the state-led development of a new Iowa Energy Plan.

Mark H. Douglas

President, Iowa Utility Association

Banking & Finance

Regress slightly

Iowa’s rural economy is in a recession, while our population centers are in the latter stages of an economic expansion. Prices for our corn and soybeans are off by 50 percent and 40 percent, respectively, during the last three years. This is having knock-on effects which are directly impacting a large part of our manufacturing base, distribution and related services, with continued negative implications for the rural workforce. The urban centers are almost in perfect juxtaposition to this, in that commercial real estate development is scalding hot, residential continues to build momentum, and the climate for business, financial and health services is robust. The divide will become more apparent in 2016, but unfortunately when I look at the environment as a whole, Iowa will see slightly negative growth overall for 2016 as the cold winds from the agricultural economy will start to affect the urban landscape. This scenario will make the environment more challenging for many of our clients, although many opportunities to provide critical financial and strategic services side by side with our partners exist.

Eric Lohmeier

President and managing director, NCP Inc.

Law & Government

Improve slightly

Job creation from a strong metro area economy will have a significant impact on cities. In the past few years, job creation has driven demand for new housing and new businesses in metro cities. Expanding cities will have to plan for new road and utility infrastructure, as well as new parks and trails that attract the workforce that growing businesses will need to continue their success. Mature cities will need to invest in redevelopment opportunities and new housing initiatives to help existing businesses grow and attract new residents.

Tim Moerman

City administrator, City of Waukee

Health & Wellness

Regress slightly

Anytime the economy contracts, competition for healthcare dollars becomes even tighter. Having said that, there will always be a need for essential healthcare treatment that is delivered in an efficient and effective fashion.

Julie Fidler Dixon

Executive director, On With Life Inc.

Tech & Innovation

Improve slightly

The economy will continue to have a positive impact on the startup community. Established companies will continue to look for new products and services to solve problems. The rapid pace of change in business will continue to highlight new business problems for startups to solve. Expected lower financial market returns will drive further interest in nontraditional investments such as angel investing.

Mike Colwell

Executive director – Entrepreneurial Initiatives, Greater Des Moines Partnership

Manufacturing & Logistics

Remain about the same

I believe this year will be comparable to last year for the construction and agricultural equipment manufacturing sector. The strength of the dollar will make exporting challenging, and low commodity prices will cause continued delays in investment in capital equipment. But the Iowa economy and overall U.S. economy will likely grow modestly. The overall result for a manufacturing company with a global footprint will likely be a fairly flat year.

Jason Andringa

CEO, Vermeer Corp.